real estate ESG frameworks

real estate esg / sustainability / sustainable real estate / green buildings

why does real estate esg matter?

The real estate industry is one of the largest in the world. Alone, it consumes around 40% of the world’s energy consumption, accounts for about a third of CO2 emissions, meaning a cohesive and coordinated approach to sustainability amongst developers is of urgent importance to the future of our planet’s health.

esg data for real estate investors

Environmental, Social, and Governance (ESG) factors are increasingly being applied across the real estate sector to enhance the ethical and sustainable characteristics of companies. Real estate ESG data helps measure and benchmark the sustainability of a real estate development company, providing investors with a greater degree of transparency.

how to create a sustainable real estate plan

Initially it may be difficult to narrow down a company’s specific objectives as the ESG standards available offer a conspicuously broad range of guidance and suggestions, however not all elements apply to all companies operating in the real estate sector.

It is helpful to first outline what a real estate developer may already be doing in terms of sustainable real estate, taking stock of any inherent sustainability credentials baked into its business model for example, such as modular construction (green building), downtown regeneration (social impact) or wellness real estate (healthy buildings).

To help us break down and prioritize these goals while aligning with industry best standards, a range of established frameworks are available for real estate ESG consultants to build upon.

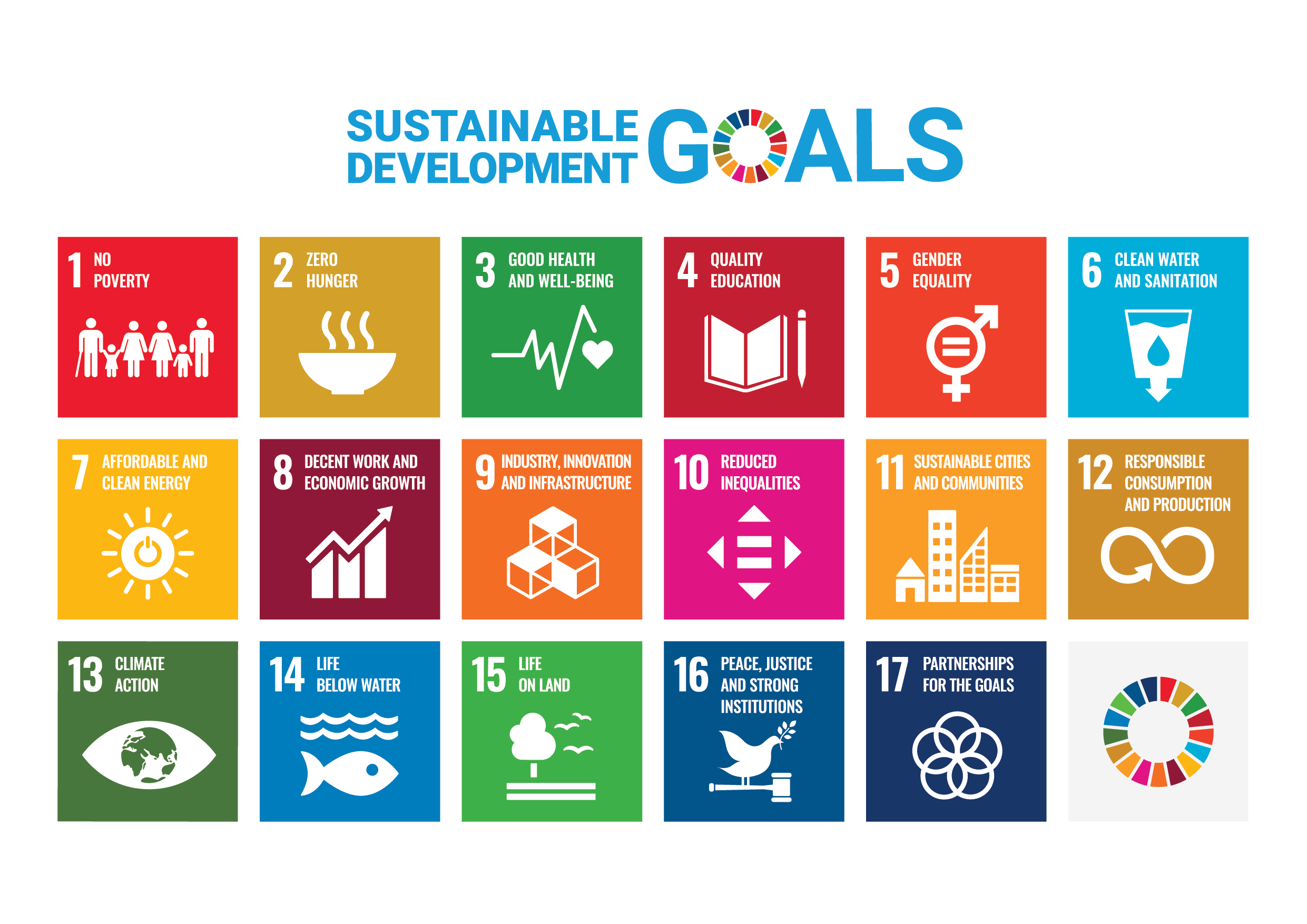

The UN’s Sustainable Development Goals, created in 2015, serve as a useful backdrop towards achieving desired impacts within any sector, this is the big picture, the view from 10,000 feet up - we should all work towards at least some of these “SDGs”!

In addition, ESG standards and tools such as SASB, the Task Force on Climate Related Disclosures (TFCD), Climate Disclosure Project (CDP), Net Zero Carbon Buildings Commitment and Global Reporting Initiative (GRI) all help guide real estate developers towards meeting their sustainable real estate goals, minimizing their environmental impact, maximizing their positive impact on human health and wellbeing, while also increasing transparency for investors.

ESG Disclosure & Transparency Benefits

The desire for real estate sustainability transparency within companies has increased as investors consider long-term success factors such as green building certifications, ethical business practices and a concern for building occupant wellbeing, community and giving back.

Firstly, sustainability disclosures can provide a better risk assessment and help to evaluate climate-related threats for the business in question, its suppliers and competitors. This can also provide insight to better evaluate risk over various timelines within the business (see “TCFD”).

Secondly, transparency can provide valuable information for the company to track and benchmark progress, both for internal and competitive industry goals. If real estate ESG objectives are met successfully, disclosures can improve a company’s image and investor interest through positive performance ( see “CDP”).

These factors can aid clients and investors into making better informed decisions and increase a sense of trust between investors and the business in question. Including non-financial analyses and goals (Triple Bottom Line thinking) in a real estate development business today will not only improve ESG alignment today but ensure further opportunities in the future by not falling behind real estate industry best practices.

UN Sustainable Development Goals in real estate esg plans

There are seventeen UN Sustainable Development Goals, together attempting to encompass and provide a guide to alleviate the greatest sustainability problems our world faces. These targets include a wide range—some being more relevant than others to ESG goals within the real estate industry.

For example, from an environmental standpoint, goals such as Goal 11: Sustainable Cities and Communities, Goal 12: Responsible Consumption and Production, Goal 13: Climate Action, and Goal 15: Life on Land may all be applicable to the real estate sector. These goals encompass strategies such as making resilient and safe communities, encouraging sustainable consumption and production, combatting climate change, and protecting and restoring native habitats (“The 17 Goals”).

Other goals can surely be applied within the ESG framework and can serve as a helpful guide and starting point for a business. For example, Goal 3: Good Health and Well-Being can be heavily impacted by the real estate sector and could fall within the social aspect of ESG strategy.

It can be difficult to imagine applying these overarching goals to a specific sector such real estate, or more so to an individual business, but they can be used as a guide. Due to the large impact of the real estate sector on global emissions and sustainability, there is a lot of room for impact.

SASB in real estate esg strategy

SASB is a non-profit organization that provides standards to aid businesses in disclosing sustainability accounting information to its investors and the public.

Sustainability accounting evaluates a company’s performance through an ESG lens, meaning that it considers non-financial capital in addition to the financial, creating a more holistic view of a company’s achievements and future trajectories (SUSTAINABILITY).

SASB has developed ESG standards in eleven sectors, encompassing 77 different industries. The standards vary by sector based on the potential risks and sustainability opportunities (SASB). The topics are decided based on what is relevant for more than half of the industries within a sector and are suggestions for what information should be disclosed (SUSTAINABILITY).

Real Estate Owners, Developers and Investment Trusts has its own set of ESG recommendations within SASB. The identified material issues include energy and water management from an environmental perspective, and from a business and innovation lens, the management of the tenants’ sustainability impacts and climate change adaptation (SUSTAINABILITY).

Through the incorporation of SASB standards, companies can diverge from traditional financial reporting methods and provide a more holistic view of their ESG performance, helping them align more closely with ESG investor expectations.

Task Force on Climate Related Disclosures (TCFD) in real estate esg strategy

Similar to SASB, the Task Force on Climate Related Disclosures (TCFD) aims to broaden traditional financial reporting, in this case to include climate-related information and financial risks.

The TCFD helps companies provide information about the risks and opportunities associated with their business as it relates to climate change, meaning investors can access a more comprehensive picture of a business, providing a more accurate disclosure of the company’s valuation and assets (“TCFD”).

As a voluntary process, the TCFD does not impose specific methodologies but rather provides recommendations for a company to follow. In this way, companies and investors can note climate related management approaches that are being used, and how they align with the TCFD’s suggested disclosures (“TCFD”).

The TCFD contains four core elements; governance, strategy, risk management and metrics and targets, which are supported by eleven recommended disclosures. These suggestions aim to increase investor and company understanding of how finances are affected by climate-related risks, which in the future will allow for more knowledgeable and beneficial investment and company growth (“TCFD”).

Within the real estate sector, the use of TCFD more than doubled in 2020 from the combined usage from 2017-2019 (https://www.wtwco.com/en-US/Insights/2021/01/tcfd-adoption-in-the-real-estate-sector ).

With the Covid-19 pandemic, greater scrutiny has been placed on the environmental impact of companies, especially within the real estate sector and its potential to help “build back better” (“TCFD”).

Disclosures related to climate are increasingly relevant within the ESG real estate realm due to its considerable impact on our climate.

CDP in real estate esg plans

CDP is a global non-profit that runs an environmental impact disclosure system for investors, companies, cities, and regions.

It was the first program created that used investor leverage to influence the rate of environmental disclosures from companies. Over time, CDP has formed a massive dataset from its users, creating a base for smart environmental decision making and a platform to track global progress (“CDP”).

Companies who disclose through CDP will find ways to mitigate their impacts on climate change and manage their environmental risks. In addition, this information will be made available to customers, investors, and the market, adding to CDP’s data and helping progress the real estate sector towards a more sustainable future (“CDP”).

After reporting and disclosing through CDP, each company is given a benchmark score based on the annual reporting trends. This score is used to incentivize companies to further improve their environmental impacts and increase disclosure.

In addition to general questions asked in the CDP questionnaire, there are sector specific inquiries that contribute to a company’s score. This scoring system allows companies within the same sector to be more easily compared and can provide important benchmarks (“CDP”).

As mentioned above, disclosure is the key first step towards increasing environmental awareness and improvement. CDP was the first standard created for corporate environmental reporting and is a helpful objective measure of how companies are performing environmentally, and therefore a useful tool to help align a real estate company with its ESG goals (“CDP”).

Net Zero Carbon Buildings Commitment in real estate esg plans

The Net Zero Carbon Buildings Commitment (the Commitment) is a more specific framework that aligns closely with the built environment and real estate sector in particular.

Born out of a collaboration between the World Green Building Council and GRESB, the Commitment encourages the decarbonization of the built environment, removes implementation barriers, and motivates execution by others.

Compliance with this commitment requires that by 2030, existing buildings reduce their energy consumption and new developments are constructed to contain extreme efficiency (“The Net Zero”).

The Commitment incorporates the whole life cycle of a building, including both embodied and operational carbon in its analyses. Due to this inclusive outlook (note - embodied carbon….), collaboration across sectors and a strategy that focuses on transparency and circularity is essential to make it work (“The Net Zero”).

The goal of this collaboration is to facilitate the formation of sector leadership and to accelerate the market towards a carbon-free future. Those that commit to the framework are required to measure, assess, and disclose performance annually and publicly, providing information on energy demand, operational and whole life carbon emissions, as well as portfolio data. With the disclosure of this information, transparency is increased, and the data can be used to inform improvements and benchmarking opportunities (“The Net Zero”).

According to the CEO of the World Green Building Council, “the Commitment provides a framework for real estate organizations to take action towards net zero carbon portfolios”, therefore providing a valuable pathway towards achieving a company’s ESG goals (“The Net Zero”).

https://www.worldgbc.org/thecommitment

GRI in real estate esg reporting

The Global Reporting Initiative (GRI) is the leading global framework for sustainability reporting. Once a company’s goals are outlined and their impacts are quantified, the GRI Standards provide a guide and common language to report those impacts (“Setting the Agenda”).

Essentially, the GRI Standards provides a framework by which to structure a company’s sustainability and ESG reports, providing a high level of transparency, clarity, and comprehensiveness (“Reporting”).

The GRI standards include both the Universal Standards, which are applicable to all organizations, and the new Sector Standards, which can provide more sector-specific reporting guidelines.

In the case of real estate development companies, there is a specific ‘Construction and Real Estate Sector’ which lists topics and disclosures that are the most likely to be material within that sector.

The GRI standards require disclosures associated with depletion of natural resources, deterioration of natural ecosystems, waste, as well as impacts on social wellbeing and community impacts.

Coupled with other available tools and standards, the GRI standards can provide a clear way for companies to report and understand their impacts on the environment and economy. This can help companies increase transparency and alignment with their ESG goals.

Sources

“The 17 Goals | Sustainable Development.” United Nations, United Nations, https://sdgs.un.org/goals .

“TCFD for Real Assets Investors.” PRI, 27 Apr. 2021, https://www.unpri.org/infrastructure-and-other-real-assets/tcfd-for-real-assets-investors/7495.article .

“CDP Homepage.” CDP, https://www.cdp.net/en

GRI Reporting https://www.globalreporting.org/

“The Net Zero Carbon Buildings Commitment.” World Green Building Council, https://www.worldgbc.org/thecommitment .

“Reporting.” Home, https://www.powercorporationcsr.com/en/responsible-management/reporting/ .

SASB, 30 Mar. 2022, https://www.sasb.org/ .

“SDGs: Answering the Big Questions for the Real Estate Industry – What, Where, Why and How?” GRESB, https://gresb.com/nl-en/2020/01/24/sdgs-answering-the-big-questions-for-the-real-estate-industry-%E2%80%93-what-where-why-and-how/ .

“Setting the Agenda for the Future.” GRI - Home, https://www.globalreporting.org/ .

SUSTAINABILITY, Shubha Mohunta DIRECTOR OF. “SASB 101 for Real Estate Owners, Developers and Investment Trusts.” Verdani, Verdani-Partners, 1 Mar. 2018, https://www.verdani.com/single-post/sasb-101-for-real-estate-owners-developers-and-investment-trusts .

“TCFD.” Task Force on Climate-Related Financial Disclosures, https://www.fsb-tcfd.org/ .